Essential Marble Export Documentation & Customs Compliance

Shipping a container of stone is only half the job; the other half is getting it through Customs at your destination. At CRAFTIMUS, we know that a single typo on a Commercial Invoice can cause days of delay and expensive demurrage charges at the port. That is why our export department treats paperwork with the same precision as our polishing. We provide a complete, error-free Marble Export Documentation packet for every shipment, ensuring your Onyx slabs and Travertine tiles clear customs smoothly in the USA, UK, Europe, or the Middle East.

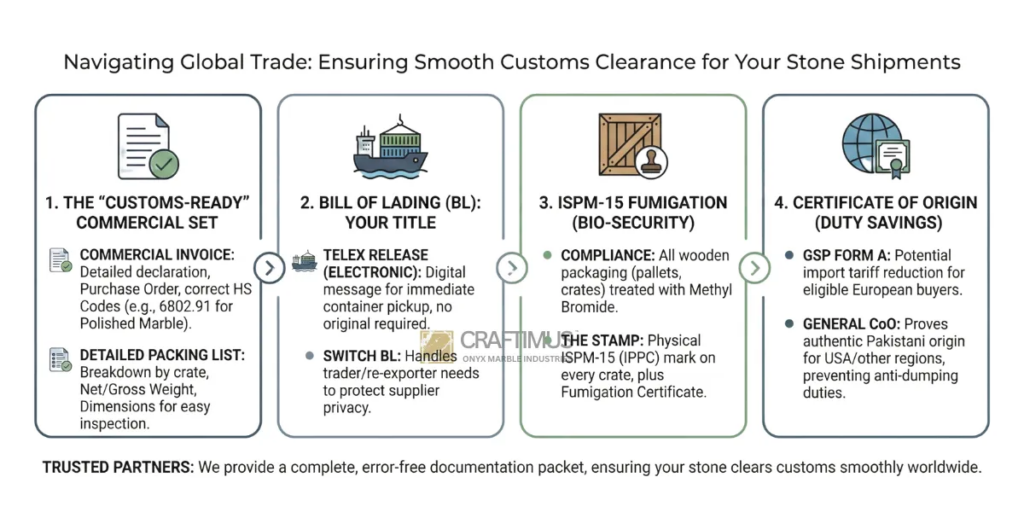

1. The "Customs-Ready" Commercial Set

Every export shipment begins with the basics. We don’t just generate generic forms; we tailor them to your specific import requirements to ensure zero friction with your local authorities.

Commercial Invoice: We provide a detailed declaration of value, including your Purchase Order number and precise description of goods. We strictly use the correct HS Codes (Harmonized System) to ensure you are taxed correctly:

HS Code 6802.91: Marble & Travertine (Polished/Processed)

HS Code 6802.99: Onyx & Other Calcareous Stone

Detailed Packing List: Customs officers hate guessing. Our packing lists breakdown the contents of every single crate—listing the Net Weight, Gross Weight, and Dimensions. If Customs wants to inspect “Crate #4,” they can find it instantly without unloading the whole container.

2. Bill of Lading (BL): Your Title to the Goods

The Bill of Lading is the most critical document—it is your legal proof of ownership. As a seasoned Marble Exporter, we work with top-tier carriers (like Maersk and MSC) to ensure your BL is issued promptly.

Telex Release (Electronic): For the fastest turnaround, we recommend a Telex Release. We surrender the original OBL here in Karachi, and you get a digital release message. This allows you to pick up your container immediately upon arrival without waiting for a courier.

Switch BL: For traders and re-exporters, we are experienced in handling Switch Bills of Lading to protect your supplier privacy.

3. ISPM-15 Fumigation (The "Wheat Stamp")

If you are importing into the USA, Canada, EU, or UK, bio-security is strict. Wood packaging cannot enter without treatment.

Compliance: We ensure that every wooden pallet and crate used for your Onyx exporter compliance is fumigated with Methyl Bromide.

The Stamp: Every crate is physically stamped with the ISPM-15 (IPPC) mark. We also provide a corresponding Fumigation Certificate for your agriculture department inspections.

4. Certificate of Origin (Duty Savings)

Did you know you might pay less import duty on Pakistani stone? Pakistan has trade agreements with several regions. We issue a certified Certificate of Origin (CoO) from the Chamber of Commerce.

GSP Form A: For eligible European buyers, this document can significantly reduce import tariffs.

General CoO: For the USA and other regions, this proves the material is authentic, 100% Pakistani-mined stone, preventing anti-dumping duties often applied to stone from other countries.

Frequently Asked Questions (FAQs)

Q: Can you customize the Commercial Invoice for my bank’s requirements?

A: Yes. We understand that Letters of Credit (L/C) often have very specific phrasing requirements. Our documentation team will draft the invoice exactly according to your bank’s instructions to ensure your payment release is not rejected.

Q: Do you provide a Mill Test Certificate for the stone?

A: Absolutely. For commercial projects requiring technical validation, we can provide a Mill Test Report detailing the stone’s Compressive Strength, Water Absorption, and Bulk Density. This is often required by architects for marble export documentation.

Q: What if I lose the Original Bill of Lading?

A: Losing an OBL is a major issue, but we can help navigate it. We usually recommend “Telex Release” to avoid this risk entirely. If you require originals, we send them via DHL/FedEx with a tracking number so they never get lost in the mail.

Q: Do you handle the customs clearance in my country?

A: We are the exporter (Shipper). While we handle all the export customs filing in Pakistan (included in our FOB price), you will need a local Custom House Broker in your country to file your import entry. We support your broker by sending them all draft documents 7 days before the vessel arrives.